NO YADA YADA

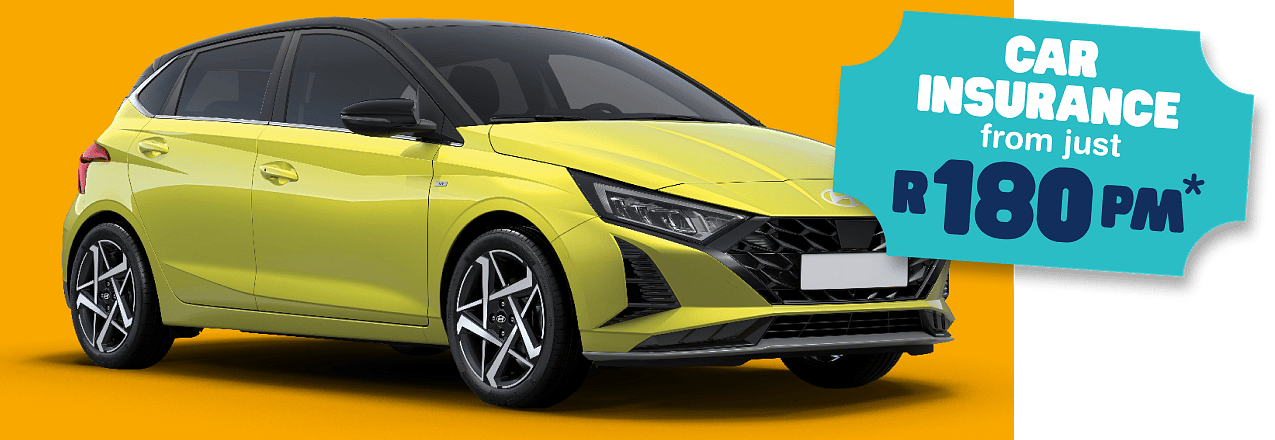

Car Insurance

- Same-day turnaround for claims

- Manage your policy via our app

- Get up to 25% of your premiums back in cash (optional)

3.89/5 | 9225 Reviews

*Non-comprehensive cover. Risk profile dependent and subject to annual reviews. T’s&C’s apply.

Why you need Dialdirect car insurance

Finding the perfect car insurance can feel like a daunting task. At Dialdirect, we believe you should have the freedom to customize your coverage to suit your unique needs. With a wide range of options available, you can rest assured that we have a policy tailored to your car and lifestyle. Explore our offerings below and discover the best car insurance solution for you.

Honoured as a Top 3 Insurer in the Short-Term Insurance Industry in the prestigious Ask Afrika Orange Index® Benchmark

This esteemed benchmark, renowned for its comprehensive assessment of customer satisfaction, emotional connection, and loyalty, surveyed over 48 000 clients and we are honoured to be ranked as Top 3 Insurer in the Short-Term Insurance Industry! This achievement is a testament to our dedication to delivering outstanding service to our valued customers.

Get cash back with Dialdirect*

customers received their Payback Bonus over the last 10 years

paid out to customers in Payback Bonus over the last 10 years

*With Dialdirect’s innovative Payback Bonus, for every four years that you are claims-free and have uninterrupted cover, you receive either your first year's premium back in cash or 25% of the value of your 4 years worth of premiums, whichever is less. Sign up now and start earning your way to a cash bonus.

**Payback is optional and at an additional cost. Cover and Payback Terms & Conditions online

Custom Cover: your car, your way

Save on car insurance tailored to your budget. Choose from our wide range of options to get the perfect cover for your needs, your vehicle and lifestyle

Comprehensive Insurance

Offers full protection for your car, covering a wide range of incidents, as listed below.

Own accident damage

Third party damage

Theft and hijacking

Glass (window glass)

Hail (Optional)

Flood

Fire and explosion

Third-Party, Fire and Theft

Peace of mind mid-range cover that offers protection against a variety of risks.

Own accident damage

Third party damage

Theft and hijacking

Glass (window glass)

Hail (Optional)

Flood

Fire and explosion

Third-Party Insurance

Entry level cover that protects you from liability for damages caused to others' vehicles or property.

Own accident damage

Third party damage

Theft and hijacking

Glass (window glass)

Hail (Optional)

Flood

Fire and explosion

Tailor your cover with our additional options

Tyre & Rim Cover

Cover for your vehicle's tyres and rims from damage caused by road hazards, including puncture repairs, wheel alignment and balancing.

Scratch & Dent Cover

Cover for the cost of repairing chips, minor dents, and light scratches to keep your car's exterior and interior looking its best.

Auto Top-Up Plus

Shortfall cover if your financed vehicle is stolen or written off, ensuring that you do not pay out-of-pocket costs.

Frequently Asked Questions:

Yes, with DialDirect you can get cheap car insurance. We think insurance isn’t just for expensive cars – everyone deserves to have some level of vehicle cover. But whether you need Comprehensive Car Cover or a cheeky little Dialdirect bundles policy, we’ll make sure you have cover that fits your budget.

Choose a car insurance policy that works for you. Take a look at the different options and figure out how much cover you need for your car relative to your budget and your lifestyle.

There are many ways to lower your premiums. Here are a few of our budget-friendly tips:

- Increasing your excess can lower your car insurance premiums.

- Switching to non-comprehensive cover based on your needs and budget.

- Speak to one of our consultants about insuring your car for a lower value, because you don’t want to be over- or underinsured.