Insurance without

the Yada Yada

Cover starting from as little as R150*

Cover starting from as little as R150* Legal support for covered claims

Legal support for covered claims We can offer up to R100 million cover

We can offer up to R100 million cover

Premiums are risk profile dependent and subject to annual review.

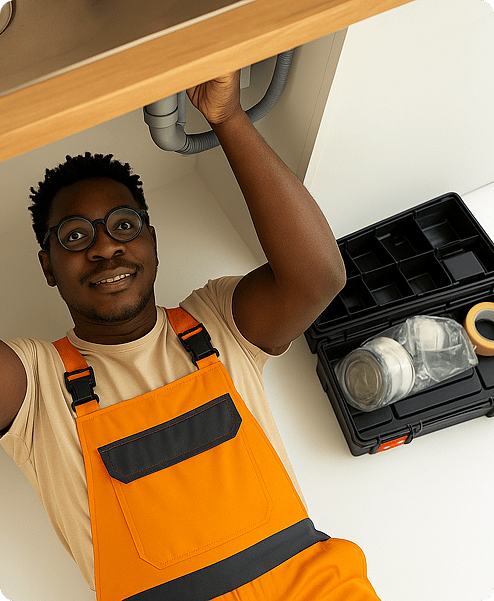

Stay protected when life throws the unexpected your way

Accidents happen, but they don’t have to derail your business. DialDirect Public Liability Insurance gives you the backup you need when the unexpected strikes. From a client tripping over a cable to accidental damage at a customer’s premises, we’ve got you covered. That way, you can keep your focus where it belongs: growing your business with confidence.

With comprehensive, affordable cover, you get peace of mind knowing you’re protected from the financial risks that come with everyday operations.

What is Public Liability Insurance?

Think of it as your business safety net. Public Liability Insurance protects you if someone gets hurt or their property is damaged because of your work, whether it happens at your place or while you’re working at theirs. If you’re found legally responsible, this cover steps in to handle the claim so you’re not left to face the costs alone. It’s reliable support that helps you worry less and achieve more.

Who needs Public Liability Insurance?

Public Liability Insurance is essential for businesses that interact with clients, customers, or the public. It protects you if someone is injured or their property is damaged because of your business activities.

Stay protected on-site and off. Cover for accidental injury or property damage caused during your trade work.

Protect your store from claims if a customer is injured or their property is damaged while visiting your premises.

Whether you're on the road or at a client’s location, stay covered against third-party injury or damage claims.

Cover for liability arising from the production or supply of goods that may cause harm or damage to third parties.

Provides cover if third parties suffer property damage or bodily injury at your premises, due to your negligence.

From spills to slips, get protection against liability claims in restaurants, cafés, or accommodation spaces.

The liability insurance your business needs, the service you deserve.

What is the difference between Public Liability, Defective Workmanship, and Products Liability?

The main difference between Public Liability, Defective Workmanship, and Products Liability lies in the type of risk or damage they cover.

Public liability insurance protects you if something goes wrong while you're working on a project, before it's finished and handed over. For example, if you accidentally damage someone's property or cause an injury during the work process, this insurance has your back.

Defective workmanship insurance kicks in after the work is completed and handed over. If issues arise due to faulty work, this insurance covers the resulting damage or injuries. However, it's important to note that neither public liability nor defective workmanship insurance will cover the costs of fixing or redoing the faulty work itself.

Products liability insurance covers any damage, loss, or injury caused by a product you've supplied after it's been handed over to the customer. For instance, if a product you sold causes harm to someone, this insurance will help cover the costs. But remember, it won't cover the cost of replacing the defective product itself.

What does Public Liability cover?

Public Liability Insurance covers businesses for third-party injury or property damage caused by their negligence.

Ensuring that business premises are safe for visitors, customers, and the public.

Making sure employees act responsibly and safely when working on third-party premises.

Taking reasonable steps to ensure that products supplied or sold are safe and do not cause harm.

Carrying out work to an acceptable standard to avoid causing damage or injury due to poor workmanship.

Get your tailored Public Liability Insurance quote today.

Extend your cover for added protection

Add optional cover to your policy for more protection.

Provides cover for alleged liable, slander, defamation, copywrite infringement which arises out of your advertising activities.

Cover for claims arising out of wrongful arrest, committed or alleged (other than by you) to have been committed in the course of your business

Cover for costs incurred by you to produce and certify any particulars or quantifications of the claim expressly requested by us in order to investigate any claim

Cover for a negligent act, error or omission in the professional services rendered or which should have been rendered by any medical practitioner, nurse or other medical official in your full or part-time employment.

This insurance extends to indemnify you for any amounts in excess of any underlying motor liability insurance as stated on your schedule. Subject to R5 million minimum underlying limit.

Cover for claims arising from negligence (other than in the provision of professional services) in the course of the business.

Cover for claims arising from injury and/or damage arising out of or in connection with any construction works undertaken by or on your behalf but excluding damage to property for which indemnity is provided in terms of a contract works policy, whether insured or not.

Cover for any other party alleging that they suffered financial loss by reason of tangible property (other than your products) being due to or alleged (other than by you) to be due to the failure of your product/s to perform as specified, warranted, guaranteed and/or to fulfil the intended function.

Cover for claims arising from negligent advise that was given in the course and scope of your work including in connection with a product but excluding advice given for a fee.

The liability insurance your business needs, the service you deserve.

What Public Liability Insurance does not cover?

While Public Liability Insurance offers broad protection, these are some of the exclusions:

DialDirect Business Insurance includes

Frequently Asked Questions: