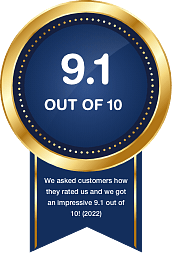

Our customers love and trust Dialdirect insurance

Download our Dialdirect app for the latest benefits

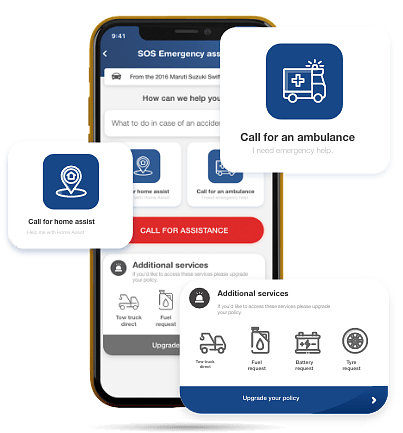

Our app has everything you need to make insurance a breeze, and we’ve dialled it up with some amazing new features and functions. You can now get SOS assistance in case of an emergency, update your policy details, view your payments, download your documents, add new household members to your policy and more, right at your fingertips.

The Dialdiary

The Dialdiary Blog articles to keep you in the know